Reviewing market and economic performance during the Biden administration

Review the latest Weekly Headings by CIO Larry Adam.

Key Takeaways

- Under Biden, the US economy added the most jobs of any president

- Elevated inflation was the Achilles heel for the Biden administration

- US equities outperformed international in all four of Biden’s years in office

A New Chapter in Politics Set to Begin Every four years, the nation swears in a new president. On Monday, President-elect Trump will be sworn in as the 47th president of the United States. Alongside the pomp and circumstance of Inauguration Day, the markets will be closely monitoring the expected flurry of activity, largely through executive actions, as Trump returns to the White House for his second term. We will keep a watchful eye on these actions, as they have the potential to alter the economic landscape and financial markets in the weeks and months ahead. As we close the chapter on Biden’s presidency, we take a moment to reflect on his legacy. While Biden will leave office with the lowest approval rating of any president (~37%), the economic and financial market results under his administration were mixed compared to history. Below, we provide a summary for Biden’s overall performance on the economy and financial markets:

- Biden’s Economic Results | While economic uncertainty was high at the start of the Biden administration due to the post-pandemic reopening, economic growth remained largely resilient throughout his presidency.

- Economic Resilience—Economic stability was a key theme throughout the Biden presidency. Despite a surge in inflation and the most aggressive Fed tightening cycle over the last 40 years, economic growth rose 15.5% (or 3.7% annualized)—the fourth best growth of any president dating back to WWII. Notably, President Biden was the only president to not experience a recession at any time during his presidency for the first time since Lyndon B. Johnson. Despite this, inflationary impacts led to depressed consumer sentiment, as Biden saw the lowest cumulative real disposable income growth (-3% and the only negative one) of any president over the last 50 years.

- Jobs, Jobs And More Jobs—The strength of the economy can largely be attributed to the health of the labor market. Since Biden took office, the US economy added ~17 million jobs without experiencing a single month of job losses—the first time this has occurred during a presidential term. The unemployment rate averaged 4.2%, the lowest for any president since Lyndon B. Johnson's 4.4%.

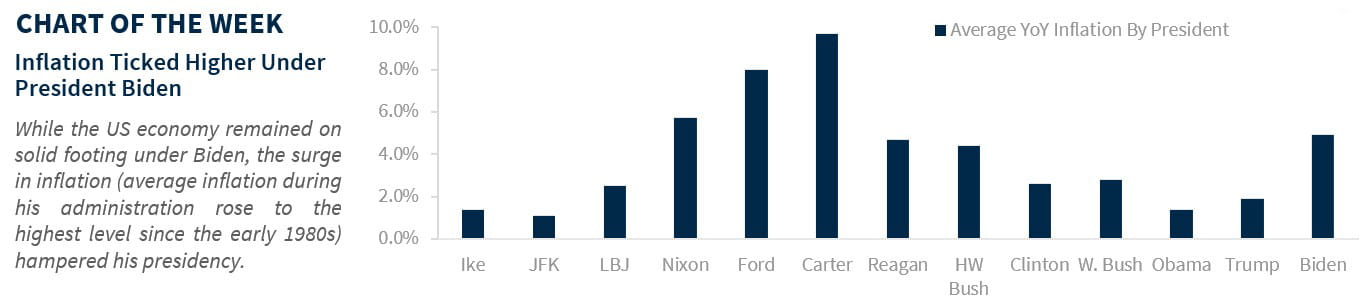

- Consumer Prices Soared—Inflation was the Achilles heel of the Biden administration. After the economy reopened following the pandemic, headline inflation soared, peaking at 9.1% in June 2022—the largest surge since the 1980s under President Carter. Consumer prices have risen over 20% during Biden’s term, equating to an annualized rate of 4.9%. While price pressures have cooled considerably (latest CPI: 2.9%), inflation has remained above the Fed’s 2.0% target for 46 consecutive months during Biden’s tenure. This likely contributed to Biden’s low approval ratings.

- National Debt Is On An Unsustainable Path—The US national debt, which recently surpassed $36 trillion, has been climbing rapidly since the Great Financial Crisis. To be fair, this increase has occurred under both Democratic and Republican presidents. Since Biden took office in January 2021, his administration has added over $8 trillion (a ~30% increase) to the nation’s debt. His administration has also run the third-largest budget deficit (6.4% of GDP) in history, and the interest expense on servicing the debt is on pace to exceed $1 trillion on a rolling 12-month basis for the first time ever.

- Biden’s Financial Market Outcomes | On the back of the resilient economy, risk assets received a solid grade under Biden’s leadership. However, the impact from stronger economic growth and elevated inflation pushed bond yields higher.

- Robust Equity Gains—The resilience of the economy and strong corporate fundamentals led to significant equity gains during the Biden presidency. Despite a temporary 25% decline in the S&P 500 due to Fed tightening and the Russia/Ukraine war, the index rose ~55% on a price return basis (11.5% annualized), marking the fourth best performance of any president since WWII. All eleven sectors posted positive returns, with tech-related sectors leading the way, driven by continued investment in technology and AI initiatives. Like the US economy, the US equity market stood out globally, with the S&P 500 outperforming international equities (MSCI AC World ex-US) by 57%, nearing the upper end of historical performance over a trailing four-year period.

- Largest Rise In Interest Rates In Forty Years—The inflationary environment during Biden's presidency caused interest rates to soar, with the 10-year Treasury yield rising from just over 1% at the start of his term to ~4.6%. Consequently, the bond market had its worst rout in history, with the Bloomberg US Aggregate Bond Index suffering a maximum loss of over 18% and enduring its longest drawdown of 54 months and counting. That index has seen –2.1% annualized performance over the four-year period—the worst performance in at least 45 years. Mortgage rates also spiked, with the average 30-year mortgage climbing from a near-record low of 2.7% to ~7.0%, making home ownership more challenging for millions of Americans. However, with interest rates at multi-decade highs, savers can earn a reasonable return on cash, with rates exceeding 4%.

All expressions of opinion reflect the judgment of the author(s) and the Investment Strategy Committee, and are subject to change. This information should not be construed as a recommendation. The foregoing content is subject to change at any time without notice. Content provided herein is for informational purposes only. There is no guarantee that these statements, opinions or forecasts provided herein will prove to be correct. Past performance is not a guarantee of future results. Indices and peer groups are not available for direct investment. Any investor who attempts to mimic the performance of an index or peer group would incur fees and expenses that would reduce returns. No investment strategy can guarantee success. Economic and market conditions are subject to change. Investing involves risks including the possible loss of capital.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. Diversification and asset allocation do not ensure a profit or protect against a loss.